Realtors, triple your business with assumptions.

Accelerate your growth with a powerful set of tools to help you become an assumption master.

Assumptions are the biggest win-win in real estate.

Assumptions are an absolute win-win proposition for buyers and sellers. That means real estate agents have an incredible opportunity in front of them…right now!

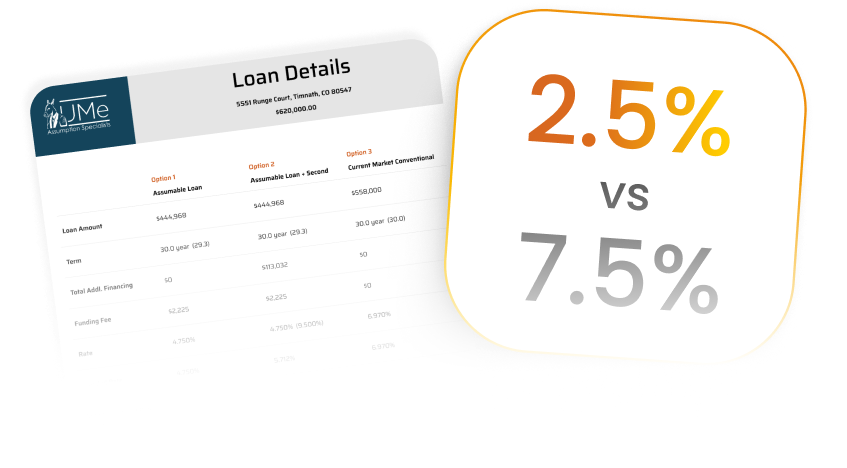

Below Market Interest Rate

Buyers are able to assume loans with interest rates as low as 2%! That's a huge win with today's high interest rate environment.

Reduced Closing Costs

Assumable loans can bypass many traditional closing costs, saving a lump sum of money.

No Appraisal Needed

Assumable loans do not require an appraisal! Compared to traditional loans, this saves both time and money.

Save time & succeed with our tools.

We offer a wide array of tools to amplify your business through assumptions.

Latest

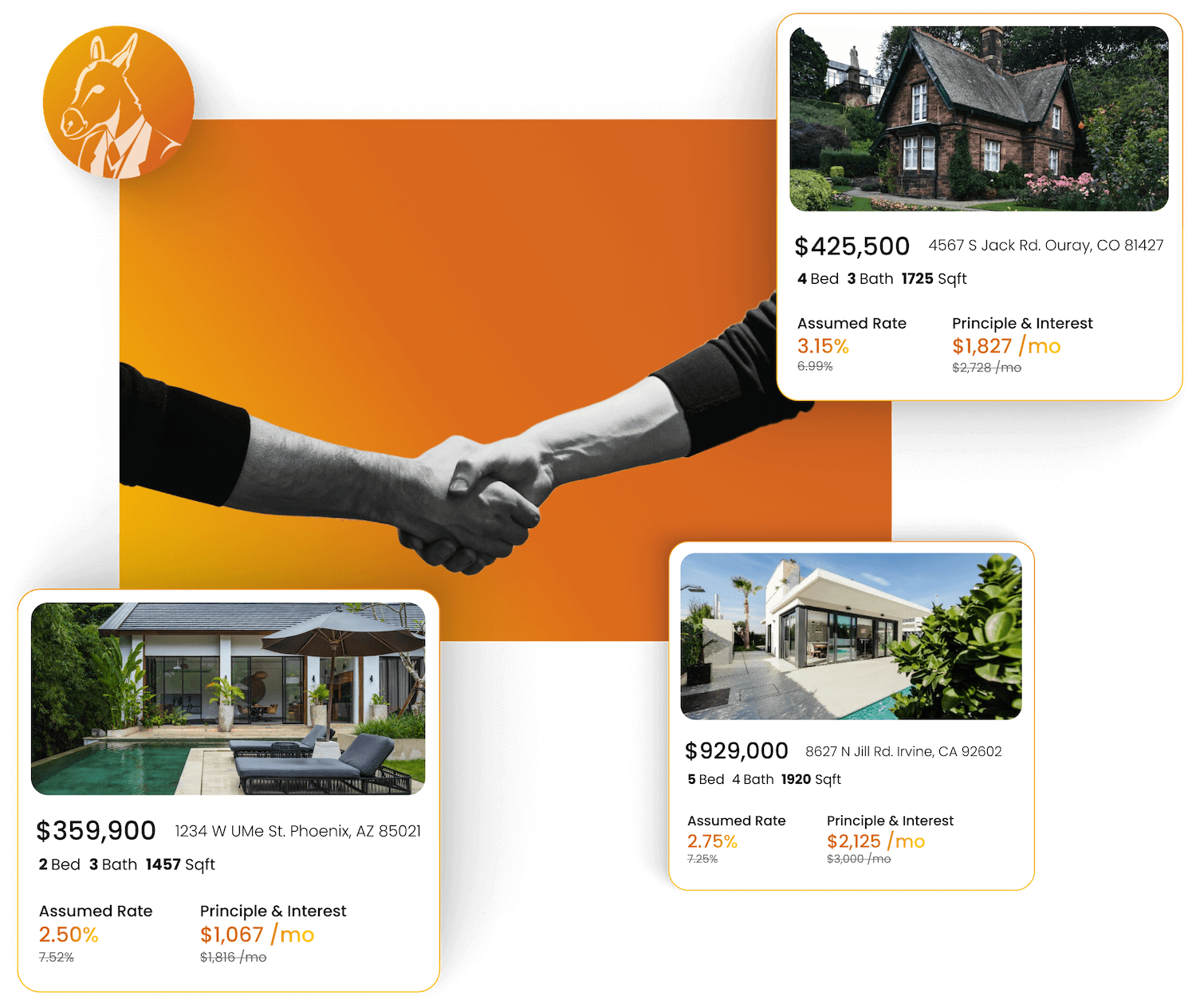

Listings

Instantly view the latest assumableproperties in your area.Updates every 10 minutes

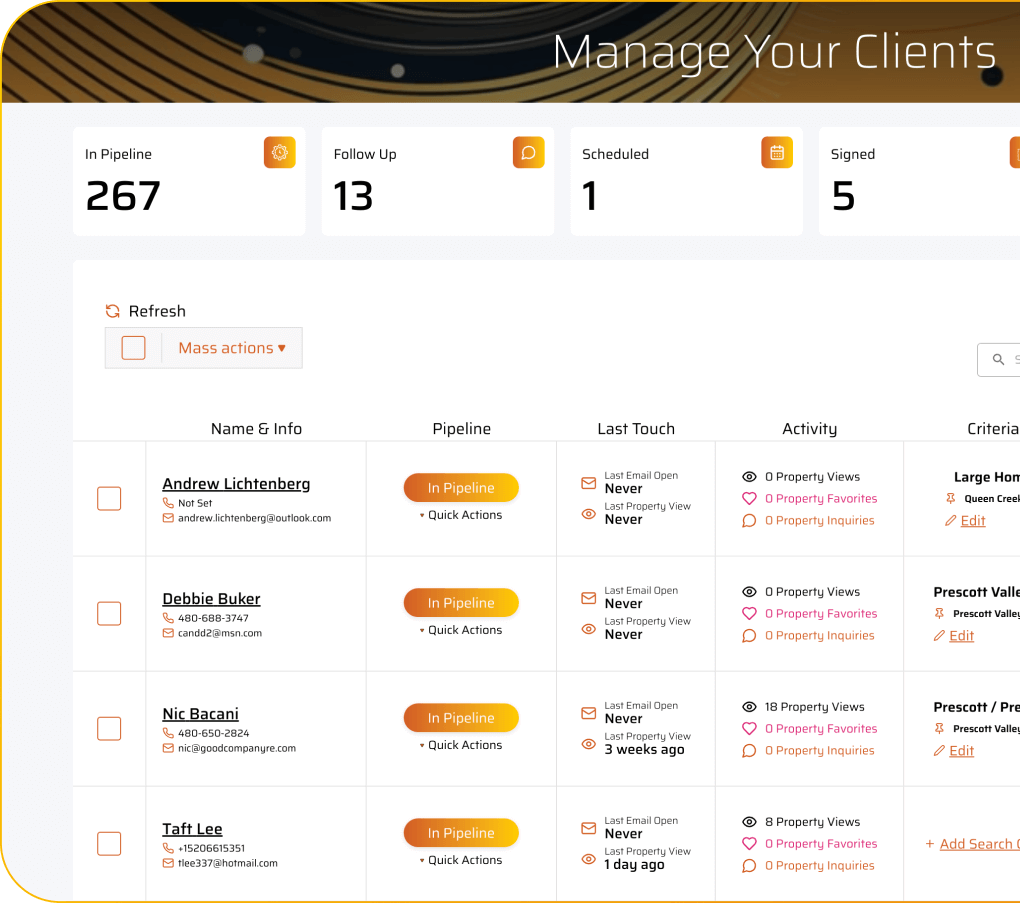

Advanced client tracking

Understand every clients unique behaviors and how they like to communicate.

Powerful client CRM

Save time and manage all of your clients through our robust CRM. Track your clients activity and push them through your pipeline all in one powerful dashboard.

Loan Comparison PDFs

Instantly get a comparison PDF of an assumable loan vs. other traditional financing for any property.

Advanced calculators

Amortization, blended rate, VA entitlement, loan comparison + more.Educating buyers and sellers is key

Real estate agents play a crucial role in educating clients about the benefits of assumable mortgages. We empower you with specialized knowledge and resources to capitalize on this growing trend.

Sell faster & for more

Help potential sellers in understanding all the benefits of assumptions. Address common concerns such as transferability and liability to showcase how assumable loans can streamline the selling process and attract more qualified buyers.

Level up purchasing power

Imagine reconnecting with buyers who previously walked away due to high payments. By educating them about assumable mortgages, you can significantly increase their purchasing power and get them the dream home they always wanted.Specialized Training & Certifications

UMe offers essential training, workshops, and customized tools to keep you up-to-date on assumption trends. This empowers you to confidently guide clients through mortgage assumptions and effectively market and close transactions.

Meet Mike Roberts, Founder

Our team is revolutionizing real estate with assumable mortgages, and we’d love to help you level up your business. By partnering with UMe, you can attract more buyers and sellers, enhance your credibility as an assumption expert, and have the potential to grow your business exponentially. Watch the video and allow me to introduce myself!

Choose your plan.

Start your journey to becoming an assumption master with our comprehensive tools and training.

Jack's Plan

For individual users

What's included:

Perfect for teams:

All plans include a 14-day free trial. Cancel anytime.

Need help choosing? Contact our team

Do You Have Any Questions?

Check out this FAQ to get more informationUMe Projects respects agent commissions while providing extra resources to help agents market homes with assumable mortgages. This increases the property’s appeal and boosts affordability for buyers.

We charge a 1% service fee based on the sale price, which is paid by the buyer at closing. This covers everything frombuyer-seller matchmaking to paperwork and lender coordination.

Yes, UMe Projects works with all mortgage servicers, ensuring a smooth process regardless of the lender.

We provide a complete agent toolkit, including flyers, customizable marketing materials, and worksheets to help collect buyer and seller information. For details, contact us at support@umeprojects.com.

Start your path in becoming an assumption expert.

Follow Us

Berkshire Hathaway HomeServices California Realty© Listing Service, All rights reserved. The data relating to real estate for sale on this website comes in part from the Listing Service. Real estate listings held by brokerage firms other than Berkshire Hathaway HomeServices California Realty are marked with the Listing Service logo and detailed information about them includes the name of the listing brokers. All information deemed reliable but not guaranteed and should be independently verified. All properties are subject to prior sale, change or withdrawal. Neither listing broker(s) nor Listing Service shall be responsible for any typographical errors, misinformation, misprints and shall be held totally harmless.

UMe Realty Group © is committed to and abides by the Fair Housing Act of Equal Opportunity.